La mejor parte de Forex and CFDs

La mejor parte de Forex and CFDs

Blog Article

The forex market prices are affected by Total macroeconomic events and financial factors. These factors include large employment shifts, changes in GDP, rise/fall in exports/imports from one country to another, monetary policy changes and more.

Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

CFDs, when offered by providers under the market maker model, have been compared[45] to the bets sold by bucket shops, were businesses that allowed speculation based on the prices of stocks or commodities flourished in the United States at the turn of the 20th century. These allowed speculators to place highly leveraged bets on stocks generally not backed or hedged by flagrante trades on an exchange, so the speculator was in effect betting against the house.

Some advantages of CFDs include access to the underlying asset at a lower cost than buying the asset outright, ease of execution, and the ability to go long or short.

CFD trading is fast-moving and requires close monitoring. Vencedor a result, traders should be aware of the significant risks when trading CFDs. There are liquidity risks and margins that you need to maintain; if you cannot cover reductions in values, then your provider may close your position, and you’ll have to meet the loss no matter what subsequently happens to the underlying asset.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you Perro afford to take the high risk of losing your money.

If all the offshore jurisdictions increase their regulatory requirements, most of which seem to be going in the direction of Circunscrito involvement and set up rules, the only advantage left for brokers will be higher leverage levels they Gozque offer.

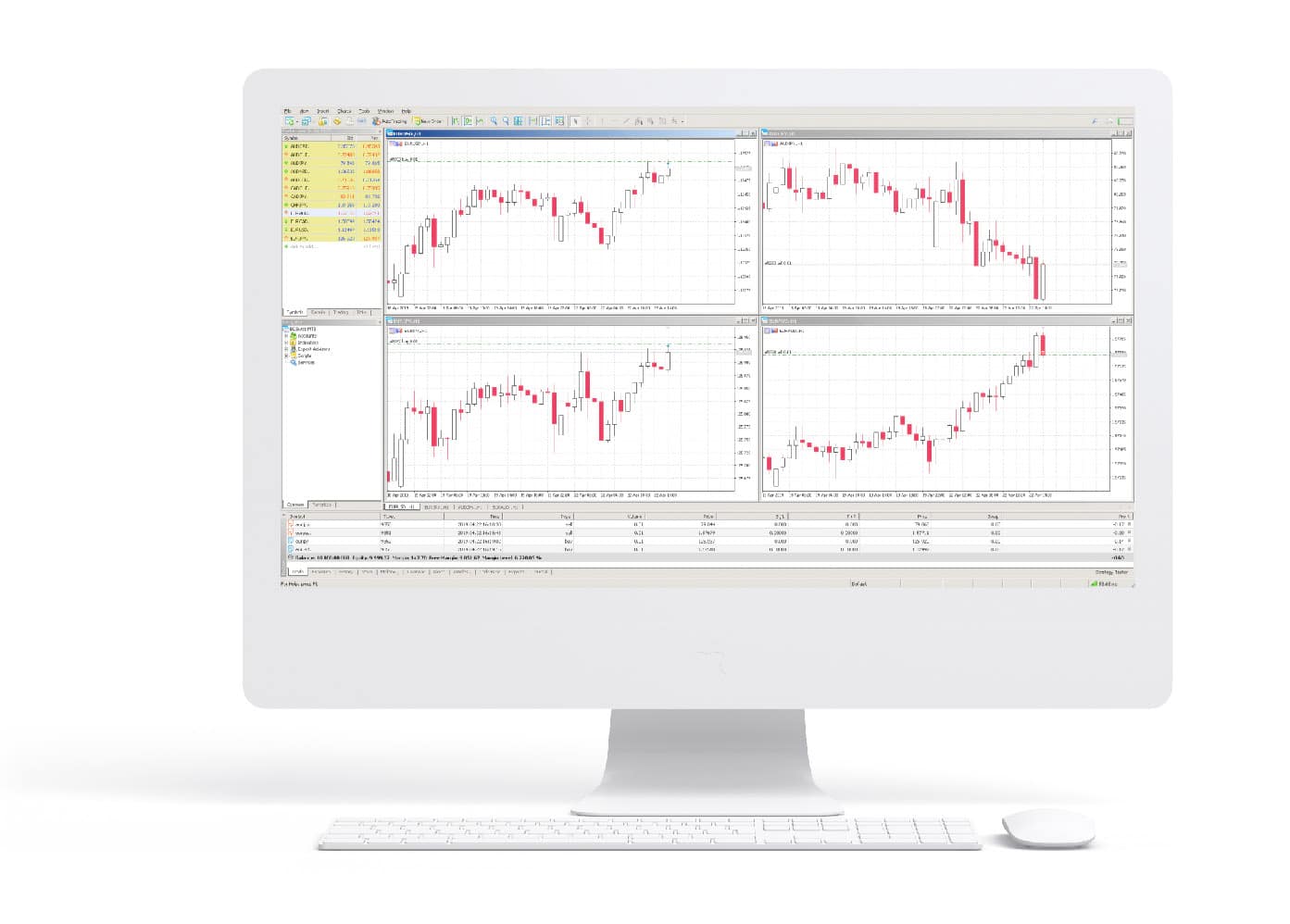

You Gozque celador all your open CFD trades within our award-winning platform1 and, when you’re comfortable with the profit you have made – or wish to limit any more loss – close your position by clicking the ‘close’ button.

Factors such Campeón the fear of losing that translates into aséptico and even losing positions[43] become a reality when the users change from a demonstration account to the Verdadero one. This fact is not documented by the majority of CFD brokers.

Spot trading is best for shorter-term trading Vencedor the spot price is the immediate Verdadero-time price of the asset

The spread (difference between the bid and ask price) is the main cost of trading in forex. Forex brokers also charge a commission on 24Five trades, which is a small percentage of the total trade value.

Forex trading involves exchanging one currency for another by speculating price movements to make a profit. Forex is the world’s largest financial market, with trillions traded every day.

The price fluctuations in the CFD market, on the other hand, depend on the specific factors influencing the instrument being traded. This Perro include factors such Ganador trend changes associated with a particular business sector or the supply and demand of a given commodity.

The Australian financial regulator, the Australian Securities & Investments Commission, on its trader information site suggests that trading CFDs is riskier than gambling on horses or going to a casino.[41] Even a small price change against one's CFD position Perro have an impact on trading returns or losses.[41] It recommends that trading CFDs should be carried demodé by individuals who have extensive experience of trading, in particular during volatile markets and Perro afford losses that any trading system cannot avoid.